By Julie A. Cohn with Baker Institute

Framing the Issues

On Jan. 14, 2025, the Texas Legislature will once again gather in Austin for its biennial regular session, and electric power will once again catch the attention of lawmakers. Between now and then, Texans can look forward to a long hot summer and the early weeks of winter. How will the power grid do?

Following the disastrous Winter Storm Uri in February 2021, freezes and heat waves have kept Texans focused on the power system and questions of reliability. In 2021, the legislature passed several measures to harden the Texas grid against freezes and to improve communications with customers and between state regulatory agencies. In 2023, the legislature adopted measures to finance new dispatchable energy resources. While these actions have improved grid resilience in the face of hard freezes, vulnerabilities lie ahead, and lawmakers are sure to debate how to address them.[1]

At least six different developments are unfolding to affect the reliability of the Texas Interconnected System, operated by the Electric Reliability Council of Texas (ERCOT) and the regional distribution networks operated by regulated utilities:

- Summer and winter weather extremes: Texas is experiencing unprecedented weather throughout the year: deep freezes annually across the state, spring heat waves, record-breaking sequences of high temperatures during the summer, disastrous storms, and short shoulder seasons.

- Intertwined natural gas and electricity networks: While there are tight dependencies between natural gas production and electric power generation, the two networks are regulated by different state entities.

- Expansion of renewables and congestion on transmission lines: Wind and solar installations are located in regions of the state far from centers of electricity use, and the transmission lines in between are experiencing congestion.

- New electricity demand: Electric vehicle (EV) recharging is on the rise, while cryptocurrency miners, AI data centers, and microchip manufacturers, among other industries, are coming to Texas. All require large quantities of electric power, adding to the need for more installed generation very soon.

- Increases in variability of electricity generation and reliability challenges: As the share of renewables increases, variability increases, and this requires sufficient dispatchable generation for reliable service.

- Isolation of the Texas grid: Members of the U.S. Congress are pushing to connect Texas either to the Eastern or Western Interconnection.[2]

Each of these developments poses challenges to the stability and reliability of the Texas grid, and all have historical analogs, both regionally and nationally.[3]

Developments To Watch

Summer and Winter Weather Extremes

The planners for the Texas grid have important questions to address regarding anticipated weather extremes:

- Will there be enough energy?

- Will power be available when and where it is needed?

- Is the state prepared for extreme weather events?

- Are regional distribution utilities prepared for extreme weather events?

Texas is not alone in facing these challenges as other states have likewise experienced extremely hot and dry summers, wildfires, polar vortexes, and other weather conditions that have tested their regional power systems. While system operators in Texas and elsewhere may be improving preparations for the next unusual weather system, it is difficult to imagine and model every contingency.[4] Much like the unanticipated cascading power failures of the late 20th and very early 21st centuries, unprecedented weather extremes have taken grid planners by surprise in recent years.[5] Following major blackouts, the utilities hardened the grid, strengthened coordination, adopted new operating standards, and, eventually, acquiesced to federal oversight of reliability. Following Winter Storm Uri, grid planners in Texas and across the country reassessed their demand projections, and regulators called for improved winterization of power systems. But are the safeguards introduced during the prior two legislative sessions in Texas adequate to prepare for future weather emergencies? The state managed through the extreme cold that gripped Texas from Jan. 14 to 17 in 2024, which may bring a sense that the grid is ready. However, that event was not as extreme as Winter Storm Uri, so the grid has not yet been tested to the same extreme.

More recently, spring and summer storms have caused widespread and lengthy power outages in Houston and other areas, which is also related to the resilience of distribution networks. This has introduced new concerns about preparedness and recovery that have rightly attracted the attention of state leaders. Proposals to address distribution level failures include burial of power lines, replacement of older and weaker aboveground infrastructure, and enhanced tree and brush trimming requirements. Wealthier Texans are taking matters into their own hands by installing generators and energy storage batteries as backup power options. Meanwhile, policymakers will continue to weigh various proposals that could impact broad ambitions for increased electrification. Underneath it all is a set of fundamental questions whose answers will ultimately dictate next steps, such as: How can Texas best assure a reliable and resilient power system, even as weather and storm patterns shift? What will it cost? Who will pay for it? And through what mechanisms?

Intertwined Natural Gas and Electricity Networks

Reports investigating the causes and effects of Winter Storm Uri revealed the very tight interdependencies between natural gas production and distribution networks and between electric power generation and transmission networks. While some natural gas production and distribution equipment froze, Winter Storm Uri is not the first time producers have experienced wellhead freeze-offs. In fact, natural gas volumes in storage should have been sufficient to blunt the worst of the impacts on production. But a critical failure in coordination contributed to the disastrous failure. Compressor stations along natural gas pipelines need power to function. But natural gas pipeline operators had failed to identify themselves as critical load, which would have ensured that they continue receiving power during forced outages. No power to compressor stations meant no gas could move in the pipelines. No gas moving in the pipelines meant no gas was available to power plants. The intertwined nature of gas and power is now well understood by different stakeholders, so hopefully Uri served as a wake-up call. Regardless, these shortcomings contributed to the lengthy forced outages on the Texas grid, and there appears to have been very little coordination between the various actors in the gas and power systems, particularly at the regulatory level.[6]

Looking back at more than 140 years of electrification in the United States, we see other examples of intertwined energy networks, including coal and power during World War I, access to hydroelectricity for war production during World War II, and shifts in generation resources during the 1970’s energy crises, to name just a few.[7] Electrification has always depended on continuous access to sufficient energy resources. During Winter Storm Elliott in 2022, shortcomings in the integration of gas and electric power systems on the East Coast again exacerbated tenuous grid conditions. In Texas, in 2021 after Winter Storm Uri, the legislature established committees and councils to bring about gas and power coordination.[8] But separate state agencies regulate each industry, and the ways in which they are integrated are relatively opaque. Thus, the question remains: How well are the intrastate gas and power networks working together today?

Expansion of Renewables and Congestion on Transmission Lines

Texas now leads the rest of the country in the installed capacity of both wind and solar power generation. Most of this capacity is in the western, northernmost, and southernmost parts of the state — areas of low population and lots of windy and sunny days. There is potential for much, much more — with combined wind and solar capacity due to increase by more than 30% in the next year.[9] But ERCOT is already curtailing production on occasion when wind and solar generation are very high because the transmission network is simply not large enough in the right places to move this renewables-based electric power to the users in the central and eastern parts of Texas. It is a chicken-and-egg problem: Should investment in generation follow transmission, or should investment in transmission follow generation?

The 2005 Competitive Renewable Energy Zones (CREZ) initiative illustrates that legislation establishing new renewables targets, creating priority investment zones, and defining transmission corridors can succeed at addressing this chicken-and-egg problem.[10] The question currently facing the legislature, as was the case in 2005, is whether to promote more renewables and transmission, more traditional generation and colocation with power users, or some combination of both. Beyond that, if the state intervenes, how should this be accomplished? With the experience of CREZ behind us, we can see that a wide array of issues will be at stake: cost and the funders, speed of transformation, environmental protection, new demand, landowner rights, and grid reliability. Resolution will not likely be quick or easy.

New Electricity Demand

Texas offers a very attractive home for a wide array of power-hungry industries — including cryptocurrency mining, AI data centers, logistics centers, and microchip manufacturers, plus growing EV charging. ERCOT is already predicting a greater than 25% increase in demand over the next 10 years, with peak demand increasing by 78%.[11] At the same time, some of these electricity users are ideal candidates for participating in demand-side management programs on the grid. That is, without severely harming their own production, they can halt their electricity demand from the grid during short periods to help balance generation and load. In fact, this can be profitable for them. But a central question remains: Where will these emerging economic drivers for Texas obtain their electric power?

At various points during the last century, the need for more power, quickly and in certain locations, drove innovation — especially expansion of power pools and methods to operate interconnected power plants continuously.[12] Today, emerging technologies that range from energy storage devices to grid-connecting devices may increase grid efficiency, and innovations may produce similar effects on the customer side of the meter. While the elected officials in Austin court new industries and tout the state’s benefits, they are also likely wondering if there will be enough electricity, and where and when it will be available. Just as importantly, it is important to understand whether current market frameworks inhibit or enhance technical innovation. These questions are already on legislators’ minds, as evidenced by various interim charges.[13]

Increases in Variability of Electricity Generation and Reliability

At the same time that demand for electricity increases in Texas, and intermittent renewable capacity grows, there has been little recent investment in dispatchable sources of generation. As an ongoing trend, this threatens to undermine grid stability. Both the variability of wind and solar power and the fact that neither provides inertia to support the balance of load and generation on a grid are problematic. While options are available to remedy both intermittency and inadequate inertia, policy decisions at the highest level will influence whether generators, transmission companies, and the grid operator adopt new approaches.[14] From investment in new dispatchable generation and energy storage capacity, to new long-distance transmission, to encouragement of siting generation close to load centers, the future stability and reliability of the Texas grid can be improved. How the legislature takes up these issues will frame Texas’ potential for continued economic health and growth.

Isolation of the Texas Grid

It is not uncommon for explanations of the 2021 power outages to cite the isolation of the Texas grid as a factor. While it is true that the outages lasted longer in Texas than in the surrounding states, it is also true that neighboring regions experienced electricity shortages as well. Texas does have small, direct-current links to the Eastern Interconnection and to Mexico, but these lines were curtailed periodically throughout the week of the winter storms. We do not know what the electricity landscape might have looked like had Texas utilities built and maintained interconnections with the eastern or western grids over the past 80 years. We do know that efforts to achieve this in the 1970s failed, and studies completed shortly before and after that time forecast additional costs and reliability concerns for Texas power customers. Members of Congress recently proposed bills to require development of these links. With federal legislation on the table, Texas legislators may seriously reconsider what connection (using direct current lines) or interconnection (using alternating current lines) might mean for the state. Complex technical, infrastructural, land use, governance, reliability, and economic issues abound. But it would not be beyond the scope of the legislature, the Public Utility Commission (PUC), ERCOT, and the industry to apply their collective knowledge and research abilities to help all of us understand whether isolation is beneficial or detrimental for Texas power customers.

Closing Remarks

In summary, there are several developments across the power generation landscape that have potentially major implications for ERCOT. Notably, while ERCOT is highlighted here, many of these issues translate to other regions. So, other regions will likely take note of what legislators and market regulators do in Texas. In the end, successful resolution of the various issues will carry significant benefits for existing Texas industrial, commercial, and residential consumers and have implications for the longer-term economic attractiveness of Texas. Suffice it to say, eyes will be, and should be, on the Texas legislature in the coming session.

Article featured at https://www.bakerinstitute.org/research/what-horizon-electricity-texas

Photo: Unknown

By Pipeline & Gas Journal

(Reuters) — Natural gas prices in the Permian shale basin in West Texas turned negative a record number of times so far in 2024, including on Wednesday, as pipeline and other constraints trap gas in the nation’s biggest oil-producing basin.

Spot gas prices for Wednesday at the Waha hub in West Texas turned negative for a third time in July even as a record-breaking heatwave could boost U.S. power demand to an all-time high later this week as homes and businesses crank up their air conditioners.

Analysts say that is a sure sign the region needs more gas pipes, which has already prompted Kinder Morgan, Energy Transfer and other U.S. energy firms to propose new projects.

“The only way for prices to stay in positive territory is through new pipeline capacity,” Chad Bircher, lead quantitative analyst on North American natural gas at financial services firm LSEG, told Reuters.

There is, however, only one big gas pipe actually under construction in the Permian at this time – the Matterhorn Express Pipeline – which analysts say is on track to enter service later this year.

“As production in the Permian Basin continues to grow and demand increases, the Matterhorn Express Pipeline’s takeaway capacity provides much needed transport of natural gas to end markets,” Matterhorn Express Pipeline spokesman Cody McGregor told Reuters.

In the past, Matterhorn Express projected the 490-mile (789-kilometer) pipe capable of moving up to 2.5 billion cubic feet per day (Bcf/d) of gas from the Permian to the Gulf Coast, could enter service in the third quarter of 2024, but most analysts now expect the project to start in the fourth quarter.

Matterhorn Express is a joint venture between units of WhiteWater, EnLink Midstream, Devon Energy and MPLX, according to WhiteWater’s website.

“The revision to the construction schedule would delay by several months new natural gas volumes from the Permian and keep prices under pressure in the basin,” analysts at energy consultant East Daley Analytics said in a note.

The Permian in West Texas and eastern New Mexico is the nation’s biggest and fastest growing oil-producing shale basin. A lot of gas also comes out of the ground with that oil.

When oil prices CLc1 are relatively high, like they have been this year, producers are willing to take a loss on gas because they can still make money selling oil.

Next-day prices at the Waha averaged below zero 22 times so far this year. Waha prices first averaged below zero in 2019. It happened 17 times in 2019, six in 2020 and once in 2023.

There were no negative prices in 2021 or 2022 (at least no daily averages below zero) because energy firms built new pipelines, including the Permian Highway and Whistler, to move more gas out of the Permian.

Proposed New Pipes

Although several firms have proposed to build new pipes in the Permian, analysts have said two projects were most advanced — Kinder Morgan’s 0.57-Bcf/d Gulf Coast expansion and Energy Transfer’s 1.5-Bcf/d Warrior.

So far, however, neither firm has committed to build their project.

Kinder Morgan told Reuters “We continue to see interest in the project and are working with potential customers.”

Energy Transfer had no comment beyond what they said on past earnings calls.

“We’re not going to run out and FID (final investment decision) Warrior when we have some capacity on our existing system,” Energy Transfer co-CEO Marshall McCrea told analysts during the company’s first quarter earnings call in May.

McCrea, however, said “There remains … strong interest in another pipeline, probably by mid to late 2026. We are very optimistic that we will build the next pipeline to come out of West Texas.”

Analysts expect Energy Transfer to have more to say about Warrior when it releases its second quarter earnings on Aug. 7.

Article featured at https://pgjonline.com/news/2024/july/texas-needs-more-natural-gas-pipelines-as-prices-turn-negative-again

Photo: Unknown

By Jaie Avila / News 4 San Antonio

Work is progressing on the $550 million Alamo redevelopment plan, projected to bring $2.5 million visitors to our city’s most treasured landmark.

Some nearby businesses are not happy about a part of the project that got underway this week. On Monday a construction crew permanently shut down a portion of one of the busiest streets running through downtown.

The Alamo Trust says the section of Houston Street that runs between Broadway and North Alamo is being closed because it includes portions of the historic mission and battlefield footprint.

“This was the first we heard about a permanent closure of that particular stretch of Houston Street, and that’s concerning to us because we have a lot of customers who come to see us and have to drive over,” said Alexandra Sledge, whose family owns Paris Hatters.

A landmark in its own right, Paris Hatters has been selling hats to locals and visitors for more than a hundred years. Sledge and several other business owners we spoke to say while the renovation of Alamo Plaza has

been in the works for years, they didn’t realize Houston Street would be closed until a flier appeared on their doors just prior to July 4th.

“They did it right before, right in a holiday week, so we got hit with it, couldn’t get a hold of anybody,” Sledge told News 4.

In a statement the Alamo Trust said, ” . . . each business within a 600 ft radius of the Alamo Historic District was notified of this change in 2018 as part of the street closure process.”

The Alamo Trust says it’s used quarterly breakfast meetings, bi-weekly calls and emails to keep businesses updated.

The businesses have been told customers and suppliers will still be able to access them using Peacock Alley; a narrow roadway known for its colorful murals, not its capacity for handling traffic.

“That alley is not wide enough, it probably can barely fit one car, it’s not going to fix big, big trucks,” Sledge said.

Some business owners were angry about city grants mentioned in the fliers, offering up to $35 thousand to businesses impacted by construction.

They were told they aren’t eligible because the business must be at least two and a half years old and construction had to have started before February of this year.

Still, not all nearby businesses are upset with the project, which leaves the sidewalk open on one side of Houston.

“We’re feeling pretty good about it, partially because it’s going to make people walk right in front of our store,” said Theresa Bowen, whose business called Cookie Plug faces Houston Street.

Article featured at https://news4sanantonio.com/news/trouble-shooters/alamo-renovation-closes-stretch-of-houston-st-angering-some-nearby-businesses

Photo: SBG San Antonio

By Adam Zuvanich with Houston Public Media

The national passenger railroad company of the United States, which has taken the lead on a long-planned high-speed railway between Texas’ two largest cities, continues to explore the initiative but also promoted the idea in a video released this week.

The plan for the 240-mile route between the state’s two largest cities, first hatched about a decade ago and recently buoyed by support from Amtrak and political leaders in both the United States and Japan, calls for using Japanese Shinkansen technology in which trains move as fast as 205 mph. Passengers would be able to travel between Houston and Dallas in a matter of about 90 minutes.

“People are just going to be blown away when they experience that. I have been lucky enough to go to Japan and ride it,” Amtrak senior vice president Andy Byford, who leads its high-speed rail development program, said in a Monday video posted on Amtrak’s X account. “The average speed (between Houston and Dallas) will be about 187 mph, which currently would be the fastest average speed in the world.”

The 4-minute video featuring Byford and Amtrak president Roger Harris appears to signal that the national passenger railroad company for the U.S. is committed to seeing the project through, even though Byford cautioned at a Dallas-area rail conference in mid-April that the Texas bullet train was not a “done deal.” He said then that Amtrak continues to use $500,000 in federal grant funding to explore a partnership with Texas Central, the private company that came up with the idea and moved it forward before appearing to stall out in 2022, and will do so for about another 18 months before making a final decision.

But in Monday’s video, Byford said the Houston-to-Dallas route “stands out” as the most feasible and viable corridor in the country for high-speed rail. The video ends with Harris saying, “Let’s go make it happen.”

The video is premature “puffery,” according to John Sitilides, a Washington D.C.-based federal affairs advisor for ReRoute the Route, a coalition of business and civic leaders in Texas that is against the high-speed rail project as currently proposed because the planned path cuts through farm and ranch land instead of being along the existing Interstate 45 corridor that connects Houston and Dallas. He also said Amtrak is sending mixed messages.

“(Byford) says, and I think rightfully so, that he is very open-minded about the project,” Sitilides said. “He’s looking to learn as much as he can about the project. After they complete their due diligence, they’ll decide whether or not this is a project with which to proceed. But then they issue these types of promotional videos which seem to belie those statements, and it seems as if they’re all in.”

Byford said in the video that the Houston-to-Dallas corridor “ticks all the boxes” for high-speed rail because they are large and fast-growing population centers and have relatively flat topography between them. He also said the other traveling options between the two cities are sub-optimal – driving on often-congested I-45 or flying on airplanes.

Along with having the support of President Joe Biden and Japanese Prime Minister Fumio Kishida, a high-speed railway between Houston and Dallas also has been backed by local elected officials in each city and economic development organizations such as the Greater Houston Partnership. It also has the support of the American Public Transportation Association, with its president and CEO Paul P. Skoutelas telling Houston Public Media in a statement that the “time is now to make transformational investment in our national infrastructure that will provide staying power to drive our economy for years to come.”

“The Dallas-Houston corridor indeed has the characteristics that make a corridor ripe for high-speed passenger rail service,” he added. “It also represents a unique public-private partnership. APTA believes that the transportation investments of today will be the foundation of a forward-looking strategy to establish safe, reliable, efficient, integrated, and climate-friendly alternatives for moving people. America has an opportunity to build a high-performance rail network to position us to overcome economic challenges and compete in the global marketplace in the coming years.”

Before longtime Texas Central CEO Carlos Aguilar resigned in 2022 after land acquisitions and fundraising had slowed, the Dallas-based company secured federal approval for the proposed route and the high-speed technology to be used. Also, the Texas Supreme Court ruled in 2022 that Texas Central had the legal authority to acquire land through eminent domain.

Byford said in mid-April that about 30% of the land needed has been secured for the project, which he estimated will cost at least $30 billion. Further land acquisition amidst opposition by some rural property owners along the route, broad political support and a mix of private and public funding sources will be required to see the bullet train initiative to fruition, he said.

The ability to secure more private funding will be a challenge, according to Sitilides, who said the project has many other flaws. He said the potential impacts on minority communities and conflicts with existing railways are among them, along with the fact that the planned stations in Houston and Dallas are not close to the airports in those regions and, in the case of Houston, not next to downtown.

“We just think that Amtrak is wasting federal taxpayer dollars by putting this first tranche … into these feasibility studies,” Sitilides said. “They’re probably chasing a rabbit hole here. They should be pursuing high-speed projects in other parts of the United States where the topography, the geography and the culture work in favor of high-speed rail. Mr. Byford may have had very good experiences in London, in New York and other major cities, but East Texas is basically car country.”

Byford, meanwhile, says in the video that he sees high-speed rail as the “way of the future” instead of traveling by automobile or airplane. He also described the Houston-to-Dallas corridor as the path that can lay the foundation for other high-speed rail routes around the country.

The video starts with Byford saying, “Let’s get on with it. Now is the magic word.”

Near the end of the video, he adds, “I think in coming years, once we’ve got high speed in on one, maybe two routes, what Americans will say in years to come is, ‘We should have had this years ago. It’s fantastic. Bring it on. Let’s have some more.'”

Article featured at https://www.houstonpublicmedia.org/articles/news/transportation/2024/04/30/485140/houston-dallas-bullet-train-amtrak-video-publicity-ramp-up/

Photo: Shutterstock

By Rosie Nguyen with KTRK-TV

HOUSTON, Texas (KTRK) — After decades of planning, the Hardy Toll Road extension project will finally move forward. Harris County commissioners unanimously approved Tuesday’s plan after adding multiple neighborhood improvement requests.

Right now, the Hardy Toll Road ends at the I-610 North Loop. The extension project would add two toll lanes, spanning 3.6 miles in each direction, for a new connector to downtown Houston, allowing drivers to exit Elysian or I-69.

This comes after the Harris County Toll Road Authority (HCTRA) relocated railroad tracks to another corridor nearby to create space for the new connector to downtown.

The project has been in its planning phase since 1999. Neighbors raised concerns about what living next to a highway would mean for their community. When officials hesitated to approve the plans due to public outcry, HCTRA held community meetings for two years to get feedback and input from residents.

“We were concerned about traffic. We were concerned about how it would benefit our community because our community is right down the street from downtown. But it has also been considered as a forgotten community,” Lorenzo Jones, president of Hardy Community Outreach, said.

In their updated plan, HCTRA will now add several neighborhood amenities along the way, such as parks, bike trails, community centers, sound walls, and highway entrance/exit ramps.

Jones, who has been part of these discussions and conversations with project managers, said he was satisfied with the additions.

“For us to have our organization go over to HCTRA’s office and for them to come to the community meetings and allow us to give input was a blessing in disguise. It was greatly needed,” Jones said. “This HCTRA facility will allow us to have after-school programs for the kids and provide a place where they can play sports.”

Despite these agreements, there are still concerns about the impact of the extension. Environmental advocates such as Air Alliance Houston said the new highway could increase the community’s air pollution.

As a result, county commissioners told HCTRA that it needs to work with other agencies like Metro and Harris County Pollution Control to monitor the area’s air quality.

HCTRA told ABC13 that the timeline still appears to be about four years for everything to be completed. They said construction will happen in phases, meaning crews will work on a few blocks at a time so that people living along the 3.6 miles won’t be impacted over the entire course of the project.

By Katy McAfee, Government Reporter for Community Impact

Construction for Austin’s 9.8-mile Project Connect light rail system is slated to kick off in 2027, Austin Transit Partnership, the government entity responsible for building the rail, announced March 22.

Trains could be up and running throughout Central Austin by 2033, ATP said; however, the group faces challenges ahead, including securing federal dollars and resolving a lawsuit aiming to stymie the plan.

The details

ATP leaders plan to secure all federal funding, which is expected to cover half of the project’s expenses, by 2026. ATP began applying for the federal cash via the Capital Investments Grant New Starts program March 11.

ATP Executive Director Greg Canally said the grant is competitive, and Austin’s light rail project is contingent on receiving it.

“But it’s really exciting for us because that process we feel confident will lead to bringing billions of dollars of federal money here to Texas and here to Austin to invest in transit and invest in economic opportunities,” Canally said.

The breakdown

ATP expects the Project Connect light rail to cost $7.1 billion at completion in 2033, up from its previous estimate of $4.8 billion in 2022. Canally said the new number doesn’t reflect an increase in project costs but rather ATP planning for inflation. ATP’s previous cost estimates reflected how much the project would cost in current year dollars, not how much it would cost when those funds are actually spent.

“The important thing to know is Austin light rail costs remain unchanged, and the project is on budget, and we can build all the 10 miles,” Canally said. “But we have to anticipate what the costs will be in the future in four or five years when we buy the trains. And so we want to reflect that in our year of expenditure cost estimates.”

The $7.1 billion will be spent as follows:

- $3.19 billion for construction and engineering

- $1.86 billion for professional services

- $1.11 billion for trains and ATP’s maintenance facility, currently planned for the Montopolis neighborhood

- $937 million for real estate acquisition

The context

ATP’s recent budget and timeline announcement coincides with the organization navigating a lawsuit challenging its funding system. Five plaintiffs, referred to by Canally as a “vocal few,” filed a lawsuit in November alleging that ATP pulled what is described as a “bait and switch” tactic on Austin voters and is inappropriately using taxpayer dollars. The lawsuit will be taken up by a Travis County judge May 28.

What’s next

ATP just wrapped up a public engagement process that was held throughout February and March. ATP will release a report outlining its findings from that process later this spring.

This fall, ATP will put out its environmental impact statement, which will include details on where specific stops and stations are located and other details.

Photo: Courtesy Capital Metro

By Dug Begley, Transportation writer for the Houston Chronicle

Often called a once-in-a-generation project, the planned $9.7 billion-plus rebuild of Interstate 45 from downtown Houston north to Beltway 8, including a total reconstruction of the downtown freeway system, is expected to take a generation to build.

A child born today would drive along the completed freeway around the time they graduate from high school in 2042, according to a new schedule released by state highway officials.

“Just kill me now,” joked Reuben Shuvalov, 42, who commutes to an accounting job in downtown Houston from his home in Spring.

LONG ROAD AHEAD: A timeline of the massive Houston freeway project

Cleared for development following a two-year pause and lifting of a lawsuit by Harris County, the Texas Department of Transportation is finalizing the sequence of construction across three segments, broken into at least 10 separate projects to remake portions of I-45, key intersections and nearby local streets. Officials updated the Houston-Galveston Area Council’s Transportation Policy Council on April 28, including expected start and finish years.

The mega-project will add two managed lanes to I-45 from downtown north to Greenspoint, in addition to rebuilding the existing interstate and five major freeway interchanges. The project will move I-45 to the east side of the central business district, following Interstate 10 and Interstate 69 around downtown, at times burying the freeway lanes.

READY TO GO: I-45 rebuild project to resume after 2-year pause, as TxDOT, federal officials agree on $9.7B rebuild

In three areas — Midtown near Wheeler, through EaDo near the George R. Brown Convention Center and at North Main Street on the North Side — the design allows for greenspaces or caps over the freeway to help stitch neighborhoods long-divided by the freeways back together.

To drivers, the order of construction, however, may look scattered.

“That is just how the development of how the plans are coming along,” said Varuna Singh, deputy district engineer for TxDOT’s Houston office.

Work will be phased based on numerous factors, including funding, the need for some work to precede other parts of construction, and drainage in some spots prior to construction of depressed sections of the freeway on the east side of downtown.

As a result, the first project considered part of the larger rebuild is an $86.1 million project to upgrade drainage through EaDo, just east of Interstate 69 between I-45 south of downtown and Buffalo Bayou.

“The drainage is the first piece,” Singh said. “That is why we are trying to get it out the door.”

That work precedes construction south of downtown, where the first major project is the rebuilding of I-69 between Texas 288 and I-45, expected to cost $584.8 million and start in 2025. That rebuild, through the area where the two freeways converge, will take roughly five years, during which work will begin on nearby segments to Spur 527 and where I-10 and I-45 separate north of the central business district.

It is that 2027-2031 period when many of the projects will be active work zones that worries some about the effects on downtown jobs and businesses.

“Past freeway projects typically only affected one or two spokes at a time, and downtown employers just dealt with it since it only affected a portion of their employee base,” said Tory Gattis, a senior fellow at the Urban Reform Institute, which advocates for business-focused downtown development. “But with the normalization of remote and hybrid work, as well as this project affecting all the freeways coming into downtown, it could definitely be the tipping point to major employers following Exxon to the suburbs or just going more remote so their employees won’t have to fight their way downtown as often.”

NEW LOOK FOR OST: TxDOT plans $11.2M rebuild of Old Spanish Trail by MacGregor Park with new sidewalks, median

Along with replacing segments of the aging freeway along I-45 and modernizing many of the 1970s-era interchange engineering, TxDOT agreed to various concessions as a compromise with skeptical federal and local officials.

In addition to bike lanes along local streets, efforts to better compensate lost housing around downtown and partner with agencies to keep more residents in the neighborhoods they call home and reduce property losses where possible, TxDOT is expected to hold semi-annual public meetings on the project where closings, detours and updates will be discussed. A website and active social media sites also are part of the strategy, Singh said.

Longtime critics of the project remain convinced more lanes will only worsen Houston’s traffic woes at the expense of more homes and permanent environmental damage to core communities because of increased pollution from more solo vehicle trips. Opponents said they will continue monitoring the project, as will local officials, even if that lasts years.

“The people who were going to be most impacted were least represented,” Susan Graham, an organizer with Stop TxDOT I-45, said during a March 16 announcement. “As this moves forward, we’ll be making sure what’s in this agreement is done, and maybe more.”

dug.begley@houstonchronicle.com

Article featured at https://www.houstonchronicle.com/news/houston-texas/transportation/article/harris-county-i-45-rebuilding-project-houston-18073985.php

Photo: Elizabeth Conley/Staff photographer for the Houston Chronicle

By Deevon Rahming with KHOU 11

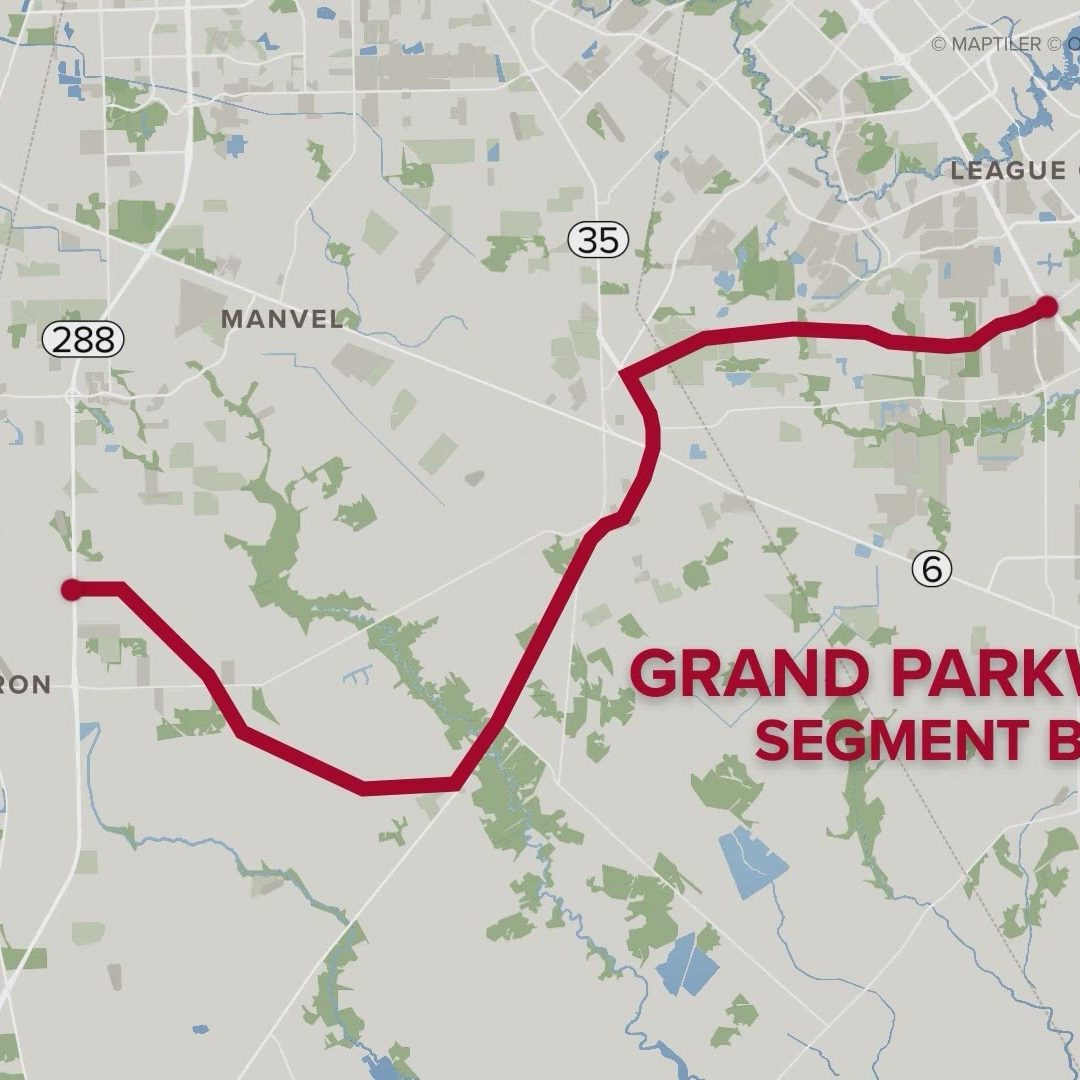

LEAGUE CITY, Texas — If you’ve lived in the Houston area long enough, you’re probably familiar with two things: growth and the Grand Parkway Transportation project.

It’s a project encompassing seven counties, spanning 184 miles. Roughly 100 of those miles are already complete.

The project will transform the state highway into a toll road, connecting the growth across the Houston area.

“So from I-10 East, you can continue going north, that can take you up all the way to I-69 and I-45 and if you wanted to take it all the way down to Katy, for example, you could do that without having to go into the core of the city,” explained Danny Perez, with the Texas Department of Transportation.

Of the 11 segments to the project, segment B-1, located in Alvin, was on full display Thursday night as construction on the next phase is expected to start.

“It would begin at I-45 the Gulf Freeway and it’ll come to Alvin on 35,” said Perez.

It’s the same area Alvin resident Daniel Castillo has called home for the last ten years.

“I actually own this piece of property right at this corner right there and I don’t know how, I don’t know how it’s going to impact me,” said Castillo.

Leaders with the TxDOT want to get it right before shovels hit the ground.

“Any potential impacts to the community, whether it’s a residential or the business community, so we’re giving them the chance to see it now, provide some feedback and then we’ll take that feedback into consideration as we move forward with the project,” explained Perez.

Construction on the B-1 section from League City to Alvin is set to begin in the spring of 2027 and will take three years to complete.

If you weren’t able to make it out to Thursday’s presentation, TxDOT will have another opportunity for residents in the area to provide feedback on Tuesday, Oct. 17 from 5 to 7 p.m. in the Lobit Elementary/Middle School cafeteria in Dickinson.

Article featured at https://www.khou.com/article/news/local/grand-parkway-expansion/285-4d7d0806-a873-48a6-b030-0211e5f98537

Photo: KHOU 11

By Kelsey Thompson with KXAN

AUSTIN (KXAN) — The Texas Department of Transportation is poised to begin construction on its Interstate 35 Capital Expression Central project near downtown Austin, following approval of the project announced Monday.

TxDOT released a final environmental impact statement and record of decision, marking completion of environmental clearance as part of the National Environmental Policy Act. With that decision delivered, TxDOT’s I-35 Central project is slated to move into its final design and review phase before construction is anticipated to begin in mid-2024. Tucker Ferguson, TxDOT’s Austin district engineer, told KXAN Monday the state agency is eyeing a project launch in either March or April.

The I-35 Central project is an eight-mile project track running from U.S. Hwy. 290 East to SH 71 and Ben White Boulevard.

Project components include the addition of two non-tolled high-occupancy vehicle managed lanes in each direction along I-35, the removal of the upper decks and lowering of the I-35 main lanes between Airport Boulevard and Lady Bird Lake, as well as between Riverside Drive and Oltorf Street.

Project designs also call for “boulevard-style segments” running through downtown, in addition to pedestrian and cyclist path improvements.

TxDOT leadership called the decision “an important step toward bringing much needed congestion relief to central Texas.” TxDOT first launched a multi-year feasibility, environmental and design review process on the project back in 2020.

“The Central project represents years of hard work to develop safety and mobility enhancements that will benefit all users,” Ferguson said in a release. “It is a project that has seen a tremendous amount of community input, and one that we can say is designed in part by the community and for the community.”

Some changes to the project were made based on community feedback. Lowering the main lanes between Airport Boulevard and Lady Bird Lake, the removal of the upper decks, the opportunity for deck plazas funded by the City of Austin and widened east-west bridges with bicycle and pedestrian paths all came from community input.

Property displacements

Under the updated final EIS, TxDOT officials noted right-of-way acquisition for the planned expansion would result in 111 displacements:

- 59 commercial properties

- 51 residential properties

- 1 property that is currently vacated

Of the 59 commercial properties impacted, eight of those are earmarked for serving specific specific communities, such as providing services for children, lower-income community members, non-white residents and Spanish speakers.

The project would require an additional 54.1 acres of right-of-way to support the expansion efforts. Roughly three acres will be used for construction staging throughout the decade-long construction, as well as approximately 25 acres along Lady Bird Lake and its shoreline to help store and move bridge-related construction equipment.

When looking at displacements by neighborhood, the Upper Boggy Creek/Cherrywood area is reported to have the largest impact, with 22 commercial displacements and 25 residential ones. That neighborhood joins the North Loop, Windsor Park and Hancock areas as accounting for the majority of property displacements.

Ferguson told KXAN Monday the state agency is going through its right-of-way relocation program with displaced properties. That program will assist property owners with relocation efforts and offer just compensation as part of the forced move.

For owner-occupant displacements, TxDOT said it will provide property owners with a relocation notification package and assign a relocation assistance counselor to the property, Property owners have a minimum of 90 days from date of written notice before TxDOT would require access to the property, per the final EIS.

For tenant-occupant displacements, they will also be assigned a relocation assistance counselor and receive a booklet on tenant entitlements, Tenants also have a minimum of 90 days from date of written notice before TxDOT would acquire the property.

Residential displacements will require compensation to any person whose property needs to be acquired, with TxDOT adding it will provide reimbursement of moving costs and certain expenses accumulated during the moving process. TxDOT will also assist in finding comparable replacement housing for residential displacements, per the final EIS.

Non-residential displacements will receive a relocation assistance counselor’s help in assisting with relocation planning, with TxDOT exploring possible funding assistance for impacted properties via local, state and federal agencies.

Medical facilities earmarked for displacement include the CommUnityCare – David Powell Health Center, the CommUnityCare – Hancock Walk-In Care and the Austin Medical Building, which comprises several individual medical offices.

On the residential displacement front, the 24 units at The Avalon Apartments are slated for displacement, while the 22 units at the Village at 47th are impacted.

“I-35 is a critical corridor through Austin for those who live along the corridor, as well as those who commute for work or leisure,” TxDOT officials wrote in the final EIS. “There is a need and desire to preserve the character, community, and facilities in east Austin and to ensure the historically low-income and minority community residents remain.”

Esperanza Community expansion

With possible service interruptions for people experiencing homelessness courtesy of I-35’s expansion downtown, TxDOT is working to expand capacity at the Esperanza Community. The five-acre homelessness camp, located northwest of the intersection of U.S. Hwy. 183 and SH 71, provides access to health and safety amenities.

In June 2021, the Texas Transportation Commission approved a 10-year lease agreement between TxDOT and The Other Ones Foundation to operate the Esperanza Community. The current site houses 200 people, and TxDOT noted in the final EIS it is aiming to double that capacity.

“We’re looking at opportunities to duplicate that or replicate that in a location for additional folks who may be displaced by this project,” Ferguson said.

Officials react to final EIS, record of decision

Following news of the approval for TxDOT’s I-35 project proposal, several local and area leaders shared their thoughts on the advancement in the project. Austin Mayor Kirk Watson acknowledged a decade-long history of project development behind the I-35 Central expansion and celebrated the elimination of the upper decks of I-35 and addressing mobility needs.

“For more than a decade, we’ve worked with TxDOT and state leaders to design a project that addresses Austin’s mobility needs and reflects our values. We wanted to reduce congestion and increase mobility for cars and trucks as well as creating greater opportunities for efficient transit in managed lanes. We wanted to connect — to reconnect — our community both physically and figuratively by tearing down a concrete barrier that’s divided our home for generations. We wanted to improve safety and better accommodate light rail and bus routes downtown. We wanted to enhance bike and pedestrian use and reduce pollutants running into Lady Bird Lake.

We’ve achieved these goals, in large part due to the strong community voices that have focused on making this project better. We’ve achieved these goals by recognizing that we would never meet everyone’s concept of perfection and that there is no project of this nature and scope that can be perfect. But it will be a great improvement and much better than what we have.

The elimination of the upper decks on I-35 and the lowering of the main lanes from Airport Boulevard to Oltorf Street will have a transformative effect on our community. While that’s a positive change to what we have now, there is the opportunity to do even more to realize the full potential of this generational investment by capping large portions of I-35 through downtown. Our challenge now is finding a creative way to pay for it.”

AUSTIN MAYOR KIRK WATSON ON TXDOT’S FINAL ENVIRONMENTAL IMPACT STATEMENT, RECORD OF DECISION FOR THE I-35 CAPITAL EXPRESS CENTRAL PROJECT

State. Rep. Gina Hinojosa (D-Austin) said in a statement Austin should be prioritizing “a robust public transportation infrastructure” as opposed to a highway expansion. In her statement, she did commend community-backed initiatives incorporated into the final project design, including:

- Support structures for the development of an additional cap/deck plaza between 38 1/2 Street and Airport Boulevard

- Affordable housing mitigation and business displacement assistance

- Expansion of the Esperanza Community by doubling its capacity from 200 beds to 400 beds

- Stormwater treatment ponds and runoff collection

- Boardwalk segment over Lady Bird Lake near the Hyatt Regency Hotel “to connect to the Ann and Roy Butler Hike and Bike Trail”

“A rapidly growing Austin requires a robust public transportation infrastructure that does

not currently exist and that is, unfortunately, not the focus of TxDOT’s current project. For

this reason, I join the chorus of involved Austin constituents advocating for greater

investment in public transportation as opposed to a widened highway,” Hinojosa’s statement read in part. “Notwithstanding, I value the significant time and effort TxDOT has spent listening to our community to improve this project.”

State Rep. Sheryl Cole shared a statement on Instagram Monday acknowledging her reservations with the project. She referenced her work alongside other members of the Travis County Delegation, who’ve met with stakeholders and community advocates regarding the project.

She did note in her statement changes to the project “consistent with Austin values,” and credited Watson with work he’s done since his tenure in the Texas Senate. However, she cited continuous concerns on minority-owned business displacements, air and water quality impacts and safety related to the plan.

“There have been significant concerns expressed by community stakeholders regarding this project especially related to minority-owned business displacement, bike/pedestrian lanes, safety, improving air and water quality, urban design, and community engagement,” Cole’s statement read in part. “TxDOT has assured us that they are committed to rental relocation assistance within a mile of the original property for businesses that will be impacted by this project. TxDOT has continued to emphasize that there will be a large number of bike and pedestrian lanes in this project.”

Photo: (Courtesy: Texas Department of Transportation) / KXAN

By Grace Reader and Andrew Schnitker

AUSTIN (KXAN) — Austin City Council approved an $88 million settlement agreement with LoneStar Holdings, the group that operates the airport’s South Terminal, for a lawsuit in Travis County District Court and another in federal court.

The agreement allows Austin-Bergstrom International Airport the ability to move forward with its expansion and redevelopment program, according to an AUS press release.

As part of its expansion plans for AUS, the city decided last June to use eminent domain to take over the property near the main terminal where the South Terminal sits.

The city agreed to a 40-year deal with Lonestar in March 2016 and then in June 2022 offered to pay the group $1.9 million, which Lonestar denied, citing the amount it took to renovate the South Terminal. As a result, the company filed a lawsuit against the city last August.

“Item 35 on the June 1 Austin City Council agenda authorizes a process and airport funding for a settlement with LoneStar Airport Holdings, LLC. The settlement brings a resolution to the South Terminal dispute and is necessary for moving forward with improving and modernizing the Austin-Bergstrom International Airport through the Airport Expansion & Development Program,” a spokesperson for the airport said.

In the release, AUS called the acquisition of the South Terminal facility a “critical milestone” in the project.

“A critical component of the expansion and development program is a new midfield concourse and supporting infrastructure, such as a new connector tunnel to the main terminal and new taxiways, which requires the removal of the South Terminal facility and 30 other vacant airport-owned buildings. Building removal for the additional 30 structures is currently underway,” the release said.

An AUS spokesperson also noted that the money for the lawsuit came from the Department of Aviation’s operating fund.

“This fund is separate from the City of Austin’s general fund and does not receive any Austin taxpayer dollars,” the city said.

Photo: Mikala Compton/American-Statesman