By Janet Miranda – Reporter, Houston Business Journal

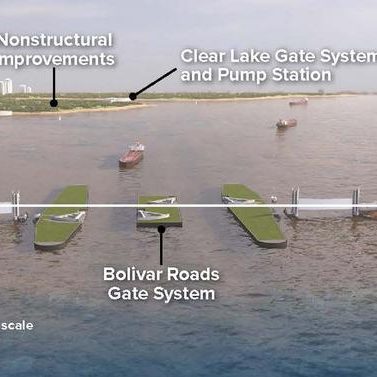

Seventeen years after Hurricane Ike devastated Galveston, the region’s long-anticipated storm barrier — known as the “Ike Dike” — has achieved a significant milestone.

The Gulf Coast Protection District recently approved two major engineering design contracts, advancing the largest coastal protection initiative in the U.S. Dallas-based Jacobs (NYSE: J) secured the contract for designing the Bolivar Roads Gate System, also known as “The Gate,” which will span the 2-mile-wide waterway separating Galveston Island from Bolivar Peninsula.

Omaha-based HDR Inc. will design the Bolivar and West Galveston Beach and Dune System, a project focused on restoring vital coastal ecosystems and reinforcing natural barriers in the region.

Spanning from Galveston Bay to South Padre Island, the project represents a comprehensive risk-management strategy for Texas’s coastline. It employs multiple lines of defense to reduce storm surge threats and restore damaged coastal ecosystems.

“Everyone’s been waiting to see some progress on this project,” said Heather Betancourth, the Gulf Coast Protection District’s communications director. “We can’t get to construction without moving those two features in design, so it’s really the first step to kind of realize the bigger portion of this project.”

By Naomi Klinge – Reporter, Houston Business Journal

A joint venture of midstream companies reached a final investment decision on a new natural gas pipeline from the Permian Basin to Katy.

The Matterhorn joint venture involves Tulsa, Oklahoma-based Oneok Inc. (NYSE: OKE), Austin-based WhiteWater, Ohio-based MPLX LP (NYSE: MPLX) and Canada-based Enbridge Inc. (NYSE: ENB), which has its U.S. headquarters in Houston.

The joint venture is developing the new 450-mile Eiger Express Pipeline, which is designed to transport up to 2.5 billion cubic feet per day of natural gas from the Permian Basin to Katy and will hold reserved capacity for deliveries to the Corpus Christi market.

The Matterhorn joint venture owns 70% of the Eiger Express Pipeline, while both Oneok and MPLX also own additional 15% stakes separate from the JV. Combined with their stakes in the JV, Oneok and MPLX own 25.5% and 22%, respectively, of the new pipeline.

By Giulia Carbonaro – US News Reporter

Texas lawmakers trying to solve the state’s housing affordability crisis passed a bill during the last legislative session that experts say will be a “game-changer” for the development of multifamily homes.

Senate Bill 840 or SB 840, which was introduced by Republican state Senator Bryan Hughes and signed into law by Governor Greg Abbott in June, would streamline the process of turning non-residential commercial buildings in the state into mixed-use and multi-family residential ones.

Under the new legislation, any land that is already classified as a zone for office, commercial, retail, warehouse or existing mixed uses could be turned into mixed-use residential housing without the need for a zone change. Essentially, the legislation does away with a process that some have complained can be time-consuming and expensive—at least in some cases.

By Tian Su at Texas A&M University

The Boom

Between 2023 and 2024, Central Texas, particularly around Austin and San Antonio, witnessed a four-fold increase in data center construction, totaling 463.5 megawatts (MW) of potential demand under development. This surge positioned the region as the second-largest data center market in the U.S., trailing only Northern Virginia ().

Notable developments included $500 million, 180,000-square-foot data center and a 13,000-square-foot flex office space at 2351 Innovation Blvd, located at the intersection of SH 130 and West US 79 in Williamson County, and in Cedar Creek. These projects not only spurred local economic growth but also significantly influenced land markets. The demand for tracts of land suitable for data center development led to increased land sales, particularly in areas with access to reliable power and fiber infrastructure.

Why Texas?

The state’s vast land availability, business-friendly regulations, and relatively affordable power (compared to coastal states) make it an attractive location for major tech firms and hyperscale operators. Beyond these practical benefits, Texas has several other key advantages that are fueling this growth:

- Central time zone: Texas’s central time zone offers an edge for global operations. For the most part, the state is also inland, meaning there are fewer risks from hurricanes, earthquakes, or coastal flooding. That geographic safety makes for more stable uptime guarantees, which are promises providers in data centers make to keep their systems stay online and operational almost all of the time.

- Proximity to key infrastructure: Texas is a prime location for data centers due to its robust infrastructure, including a vast network of highways, fiber optic cables, and access to critical power grids.

- Abundant renewable energy: Texas leads the U.S. in wind power and is rapidly scaling solar, which makes it a prime location for energy-hungry data centers looking to meet sustainability goals (). For sustainability-conscious companies like Microsoft, Meta, and Google, this makes Texas a prime destination to hit decarbonization targets.

- Lower Operating Costs: Compared to coastal tech hubs such as Silicon Valley or New York, Texas offers lower overall costs of doing business.

While property taxes in Texas are generally higher than in many other states, some communities offer property and sales tax abatements to attract businesses. Additionally, Texas generally has fewer regulatory hurdles, making it easier and more cost-effective for companies to operate and expand.

Power and Land Demands and Challenges

The Electric Reliability Council of Texas (ERCOT) that peak electricity demand for Texas could reach 218 gigawatts (GW) by 2031, more than double the 2023 record of 85.5 GW. Data centers are expected to account for the largest percentage of this growth, driven by the energy requirements of artificial intelligence (AI) and cloud computing services.

Meeting this demand will require a major expansion of Texas’ power generation capacity, whether through new renewable energy installations or additional natural-gas-fired plants. Either path carries substantial implications for land use, from sprawling solar farms and wind arrays to traditional power plants and supporting infrastructure.

The demand for land suitable for data center development not only means more sales but also transformed land-use patterns. For example, in the Permian Basin, traditionally known for oil and gas production, companies like are repurposing land for data center sites. These developments are equipped with necessary infrastructure, including power, broadband, and water for cooling, and are strategically located to leverage existing energy resources.

Texas Land Market’s Future

The Trump administration’s policies have played a pivotal role in promoting data center growth in Texas. Announced in January 2025, the Stargate Project is an ambitious $500 billion initiative aimed at establishing a nationwide AI infrastructure. The project plans to construct up to 20 data centers across the United States, with Texas serving as a central hub. These would bring demand for large utility-ready parcels.

The AI revolution isn’t just happening online, it’s being built acre by acre right here in Texas. What began as a quiet tech migration has become a full-on infrastructure rush. In Texas, land is no longer just land—it’s also bandwidth, energy, and scalable infrastructure.

Views expressed on The 338 are those of the authors and do not imply endorsement by the Texas Real Estate Research Center, Division of Research, or Texas A&M University.

Article featured at https://trerc.tamu.edu/blog/ai-land-and-power-inside-texas-data-center-explosion/

Photo: Texas A&M University

By Hailea Schultz with Greater Houston Partnership

The George R. Brown Convention Center (GRB) is set to undergo a major transformation that will reimagine downtown Houston into a pedestrian-friendly convention and entertainment district.

Mayor John Whitmire and Houston First Corporation recently unveiled a master plan for the project, marking the first substantial renovation since 2016, which opened the building to Discovery Green and created the Avenida Houston Plaza.

The $2 billion project aims to bolster Houston’s position as a global hub for sports, entertainment and tourism, an especially timely investment as the city prepares to host FIFA World Cup matches in 2026 and the Republican National Convention in 2028.

The first phase of development includes a 700,000-square-foot building, GRB Houston South, which will serve as a key connector between downtown and Houston’s East End. The building will include two exhibit halls, a multipurpose hall opening to the new Central Plaza, an atrium flex hall, ground-level retail and dining spaces and what is set to be the largest ballroom in Texas.

Additionally, the Avenida Plaza will be extended south to connect Discovery Green with the new Central Plaza, creating an expanded gathering space for large-scale events and community activities.

The project’s design is inspired by Houston’s bayous and natural prairie landscape. Along with its nature-inspired elements, the building will use eco-friendly materials and energy-efficient systems, including rainwater collection and water-saving features, to minimize its environmental impact and strengthen the city’s sustainability efforts.

The groundbreaking project will be funded by a portion of the state’s hotel tax revenue, made possible by Senate Bill 1057, which passed in 2023.

The Need for Expanded Infrastructure

With Houston’s hospitality and tourism industry rapidly expanding, the demand for expanded infrastructure has never been greater. In 2024, the city welcomed more than 54 million visitors, an increase of six percent from 2023 and nearly 10 percent since 2019, according to Houston First.

GRB Houston South is scheduled to open in May 2028, with the full project expected to be completed by 2038.

Article featured at https://www.houston.org/news/george-r-brown-convention-centers-2-billion-transformation-project

Photo: Greater Houston Partnership

By Apple.com

Teams and facilities to expand in Michigan, Texas, California, Arizona, Nevada, Iowa, Oregon, North Carolina, and Washington

Plans include a new factory in Texas, doubling the U.S. Advanced Manufacturing Fund, a manufacturing academy, and accelerated investments in AI and silicon engineering

Opening a New Manufacturing Facility in Houston

Doubling Apple’s U.S. Advanced Manufacturing Fund

Growing R&D Investments Across the U.S.

Supporting American Businesses with a New Manufacturing Academy in Detroit

Article featured at https://www.apple.com/newsroom/2025/02/apple-will-spend-more-than-500-billion-usd-in-the-us-over-the-next-four-years/

Photo: Apple

Water entities serving Spring and Klein are ramping up efforts to convert a larger portion of their water supply to surface water, aiming to reduce groundwater reliance in compliance with Harris-Galveston Subsidence District regulations.

HGSD data from 2019-23 shows the Greater Houston area continues to experience subsidence, or the collapsing of the land due to movement beneath the earth’s surface. HGSD General Manager Mike Turco said the phenomenon is often caused by groundwater withdrawal.

Officials said northwest Harris County has seen increased subsidence over the last four years. To alleviate this, water authorities must follow HGSD’s plan and have 60% of their jurisdictions using surface water by the end of 2025 and 80% by 2035.

By Jeff Vasishta

Benzinga and Yahoo Finance LLC may earn commission or revenue on some items through the links below.

Space might be Elon Musk‘s ultimate goal, but he’ll make do with a large chunk of Texas in the meantime. According to The Real Deal, the richest man in the world owns $3.4 billion of Texas real estate, which houses mostly business ventures such as SpaceX, Tesla and The Boring Company but also comprises large swathes of land where he plans to develop self-sustaining towns. Like many former Californians, Musk was attracted to the Lone Star State because of its business-friendly regulatory environment.

Slow Going

Musk’s Southern strategizing became apparent when the Wall Street Journal reported on his plans to build his own town on part of thousands of acres of newly purchased pasture and farmland outside Austin by the Colorado River, where his employees could live for below-market rents. It has since been revealed that Musk’s new town has been dubbed Snailbrook because of the slow pace of progress.

The 440 acres Musk’s companies own in the area include an 11-acre Starlink factory (that produces internet kits) with amenities for workers and a playground for his children. However, Musk also owns at least 2,500 acres along either side of State Highway 130 and 900 acres in Boca Chica. Currently, the modest prefab homes in an area branded Starbase (SpaceX’s rocket development) are nothing to write home about, but Musk plans to develop the area. There are plans to build a $6M restaurant and a $9M shopping center. An election would allow voters to cast a ballot for a slate of three new city officials, including the city’s first mayor, crucial to the incorporation of a new town. According to The New York Times, the petition suggests that the mayor will be SpaceX’s security manager, Gunnar Milburn.

Starbase, Texas

The Starbase petition describes a community of around 500 current inhabitants, including at least 219 primary residents and over 100 children. The intended location is at the end of State Highway 4 by Boca Chica Beach, close to the launch site of SpaceX rockets. The town is small by Texas standards, about 1.5 square miles.

Of course, the main reason Musk chose Texas was business. The state’s large swathes of undeveloped land make it ideal for industrial real estate. Musk owns 2.5 acres outside Tesla’s Gigafactory, conveniently close to Bergstrom International Airport. The technocrat’s personal residence is also located there – a $35 million family compound with a Tuscan Villa. 10 miles east of Austin, Musk plans to expand his Neuralink operations – sci-fi-like company that develops brain-computer interfaces (BCIs) that allow people to control devices with their thoughts – with a new office and manufacturing spaces.

Environmental Concerns

Despite a significant Texan presence, the possibility of high-paid jobs, new infrastructure and a booming economy, many Texans aren’t thrilled about Musk’s presence. A community group, Save RGV, filed a lawsuit against SpaceX for releasing wastewater into nearby wetlands. In addition, Musk has to convince local officials in Cameron County of his intentions. There is evidence that Musk might not be content with forming just one town. According to The New York Times, he has investigated the possibility of housing employees in a development outside the town of Bastrop, near Austin, where several of his businesses are located, including a manufacturing plant for SpaceX, the headquarters of the Boring Company, which creates tunneling technology and soon, offices for the social media platform X.

It’s an ambitious venture – but when has that ever stood in Elon Musk’s way?

Photo: CRE Daily

By Dug Begley with the Houston Chronicle

With the end of 2024 came the end of two major freeway projects around the area, when all lanes opened at the Interstate 69 and Loop 610 interchange and along Interstate 10 in Brookshire to the Brazos River.

New lanes, however, are always a work in progress. The Texas Department of Transportation and others are constantly adding lanes or adding travel options – some more complex than others.

The work either intensifying or wrapping up in 2025 is no different, with major progress expected on both Interstate 45 south toward Galveston and the Ship Channel Bridge.

Looming, however, is more than two decades of work starting in downtown Houston and then plodding north to rebuild I-45.

Be sure to check back regularly for updates on how these projects develop.

Article featured at https://www.houstonchronicle.com/projects/2024/houston-road-construction-projects/

Photo: Yi-Chin Lee, Staff Photographer

By Mary Cantrell with The Big Bend Sentinel

BREWSTER COUNTY — Last Thursday the Texas General Land Office (GLO) closed on a historic deal to purchase a massive 353,785-acre ranch in Brewster County from Texas Mountain Holdings, owned by Brad Kelley.

The “Brewster Ranch” was listed for $245,678,330. An assemblage of 28 historic ranches, the property complex lies primarily east of Highway 385. It abuts the 801,163-acre Big Bend National Park, 103,000-acre Black Gap Wildlife Management Area and the Rio Grande.

“It’s big, it’s Texas, and it’s wild,” states the property listing.

Kelley spent over 25 years amassing the expanse, according to James King of King Land & Water, who represented Texas Mountain Holdings in the sale. “He’s the anti-fragmentation machine — and that’s the biggest threat in Texas, is fragmentation of our landscapes — so this is a win for us who are in the conservation arena,” King said.

“It’s really awesome that the land commissioner, the General Land Office, saw the opportunity for the state of Texas to invest in Texas,” King said. “It’s going to be in public ownership.”

When the Brewster Ranch was originally listed in 2019 it was an even larger tract at 431,846 acres. Ranches on the periphery — Horse Mountain, Tesnus and YE Mesa, ranging in listing price from $14 to $26 million — were sold off over time.

King said a lot of people showed interest in the ranch, but at the end of the day “it’s hard to find a buyer for that large a scale of a transaction.” Entities thought to have a “conservation outcome,” including The Nature Conservancy, Texas Parks and Wildlife and the Park Service were in discussions.

“In the end, the GLO is the one who stood up and did the transaction,” King said.

The oldest state agency in Texas, the GLO manages the Permanent School Fund, a fund with over $56 billion in assets that distributes $2.2 billion to public schools annually. The GLO’s investments vary widely, from public lands to oil and gas leases to buildings in downtown Austin to stocks and bonds.

“You name it, they’ve invested,” King said.

In addition to the acquisition of the Brewster Ranch, the GLO recently purchased a 1,402-acre ranch along the Rio Grande in Starr County, which the agency intends to erect a 1.5 mile border wall on, according to a press release. While no official plans have been announced for the Brewster Ranch, Land Commissioner Dawn Buckingham offered the following statement to The Land Report.

“As Texas Land Commissioner and the steward of more than 13 million acres of state land, I am proud to have acquired this beautiful property for the State of Texas,” Buckingham said. “By securing this large swath of land along our southern border, the GLO is not only blocking foreign adversaries from purchasing this land but also ensuring this mineral-rich property will be generating revenue for the school children of Texas.”

Brewster County Judge Greg Henington said while he has been in touch with the GLO and the commissioner regarding the ranch acquisition, “they have not been clear about what they are going to do with it.” He said as far as he was aware no final decisions have been made.

Henington did express concerns about the estimated $90,000 in lost property taxes. “From my perspective, it’s like, okay, here’s another piece of public land coming out of my county and going off our tax rolls,” Hengington said. “I’ve been kind of working with the GLO to say, ‘Okay, well, how can you help us, so to speak.’”

King said Texas Mountain Holdings — the ranch’s previous owner — leased land out to various parties for ranching operations, and it is likely that the GLO will continue that practice for the time being. “They’re probably going to utilize that same strategy for maybe a year until they get an understanding about what they really have and what the potential uses are down there,” King said.

The GLO has an office in Alpine, and other land holdings in West Texas, including Lake Ranch south of Marfa and a ranch in the Quitman Mountains south of Sierra Blanca. “They know the business of managing land, and they know the business of working with lessees on leasing that land,” King said.

Article featured at https://bigbendsentinel.com/2024/10/30/land-office-purchases-massive-353785-acre-brewster-ranch/

Photo: Laurence Parent